We are a highly skilled technology-enabled solutions company providing both operational services and technology resolutions. Our expertise in KYC, Credit Risk, Compliance, Legal, and Technology means we give our clients the confidence of complete security.

Where traditional services companies offer human-only resource models that are costly to scale, and technology companies offer software products that still require operational resourcing, through our knowledge and expertise, we provide our clients with the best of both worlds: Technology solutions that are highly specialised to address the CLM challenges of the Investment Banking and Wealth Management industries, underpinned by skilled teams that work hand-in-glove with in-house operations.

Our Knowledge

Since 2013, we have been working with some of the biggest banks in Capital Markets and Wealth Management. The industry knowledge, expertise and proficiency across our global teams enable us to cater for our clients whilst maintaining flexibility and efficiency, whatever the landscape.

Extensive Industry Experience

We come from the finance industry and continue to stay connected across multiple banks.

Highly Specialised Products

We focus only on CLM solutions for the Investment Banking and Wealth Management sectors.

Fast and Flexible

We act quickly, helping you to transform and automate your business through technology.

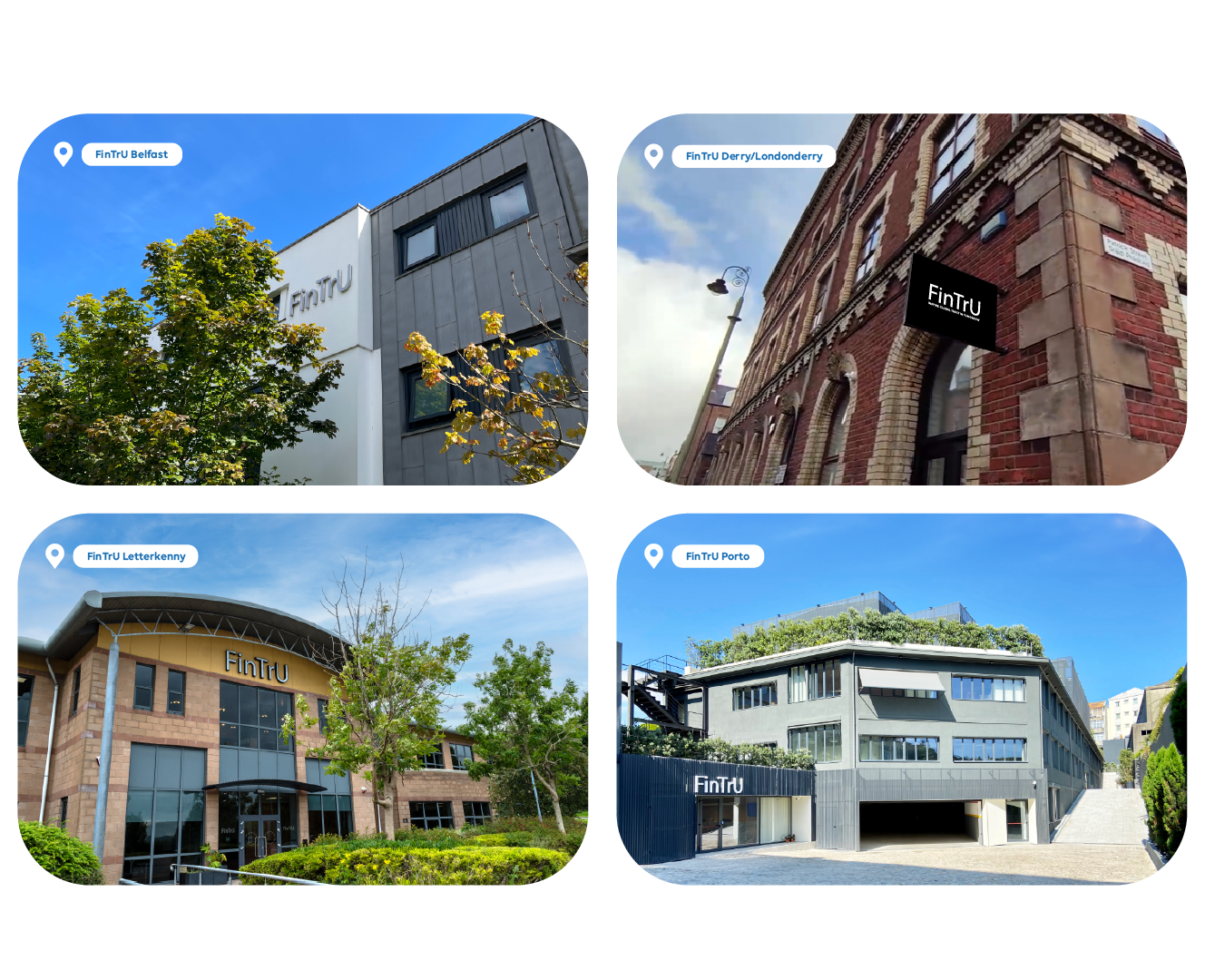

We have locations in Belfast, Derry/Londonderry, Letterkenny, London and Porto. We are a significant employer in these locations and partner with local government, universities and other businesses to support our local communities.

We have an in-house training team who work tirelessly to support all our colleagues, with CPD being an integral part of every employee's objectives.

We have dedicated training programmes aligned to our solutions offerings, and strong connections with local universities that not only enable us to hire great talent, but also offer industry perspective on the education needs for the jobs of the future.

We dedicate a percentage of our annual revenue to innovating and creating new technology solutions to solve challenges for our clients.

Whether it’s the latest application of Artificial Intelligence, or a clever use of Robotic Process Automation, a dedicated team of Data Scientists, Software Engineers, Designers and Product Managers work tirelessly to research and develop new ideas.

We pride ourselves in FinTrU for remaining agile, despite our growing scale and maturity. Our culture of responsibility and accountability allows us to make decisions rapidly, meaning we can respond and support our clients in new and clever ways very quickly.

We provide technology-enabled solutions to assist firms with their end-to-end Know Your Client and Anti Financial Crime processes. Our expert teams deliver across a broad range of services including Customer Due Diligence (CDD), Risk Assessment, Alerts and Transactional Analysis, while offering industry-leading tech solutions to support clients with CDD and Client Outreach.

Read more about KYC

We provide scale to Global Risk Management functions across Financial and Non-Financial Risk. We support the 3 Lines of Defence by leveraging our in-depth insight of industry best practice, enabling us to improve the effectiveness of business as usual or focused remediation support.

Read more about Risk

Providing effective compliance solutions to prevent and detect regulatory breaches, we implement robust controls while continually assessing the effectiveness of compliance frameworks, governance, and control structures, giving assurance for the financial institutions we work with.

Read more about Compliance

We work with clients to put in place documentation to enable them to trade financial products with their counterparties. We have a proven delivery record across a full range of Legal functions for financial institutions, with the ability to successfully scope and deliver projects regardless of scale.

Read more about Legal

We provide technology solutions that are highly specialised to address the CLM challenges of the Investment Banking and Wealth Management industries, underpinned by highly trained and skilled teams that work hand-in-glove with in-house operations. Our key products are TrU Label and Client Outreach.

Read more about Technology

We work for the largest and most complex global financial institutions from our ISO certified near-shore delivery centres across Belfast, Derry/Londonderry, Letterkenny and Porto.

Our Al-driven platforms are honed and tuned to specific and nuanced use cases that are not well solved by mainstream Large Language Models. FinTrU's in-depth expertise in KYC, Compliance, Risk, and Legal allows us to create impactful 'human-in-the-loop' solutions that drive down costs whilst ensuring compliance with regulatory requirements.

Get in touch with FinTrU